What has flexibility got to do with options?

Quite simply if you have more options, you have more flexibility. In uncertain situations, or if you are somehow keen to grow (wealth, skills, influence, reputation, character development), having options is valuable.

Of course, having more options isn’t useful if you can’t make a decision when time is pressing. And having a set of options that aren’t relevant to the problem you’re facing isn’t particularly helpful either. Unless you can trade them for the ones you actually want.

What are real options?

They’re not as scary as they sound. Wikipedia says ‘a real option itself, is the right—but not the obligation—to undertake certain business initiatives, such as deferring, abandoning, expanding, staging, or contracting a capital investment project’. In the personal flexibility sense, real options are rights we have paid for in the past and hold. If the conditions are right, they can be used (exercised) at some point in the future, to buy or sell something to benefit ourselves. Or benefit those we choose to help.

There are a couple of different types of real options. Call options are options we have purchased in the past, that give us the right to buy something. Put options are options we have purchased in the past, that give us the right to sell something.

What are some examples of call options in our personal lives i.e. things we’ve paid for in the past that give us PFL in the present and future?

- Loyalty points, or frequent flier points accumulated, that are still valid. Purchase qualifying items and you have the right to use the points to obtain discounts on future purchases.

- Multiple passports (the legitimate right to citizenship in multiple countries). Pay the application fee and once the passport is issued, you then have the legal right to buy the same things the other citizens can buy.

- Insurance policies with a claim excess. Pay the insurance premium, make the claim, pay the claim excess and the item will then be replaced.

- Personal credit cards and overdraft facilities. Pay the annual account fee and any interest charges to access the credit amount.

- Fitness, health and knowledge you’ve built up, if they qualify you for access to something fairly exclusive in the future, that costs money.

- Physical and data security measures and investments made. Pay the fee, log your security breach event, pay for the investigation and hopefully damage will be remedied.

- Divorce papers – once signed and the divorce lawyer costs are paid, the papers give you the right to legally marry another person (providing they’re not already still married).

![IMG_3150[6155]](https://fisccollection.files.wordpress.com/2018/12/IMG_31506155.jpg)

What are some examples of put options in our personal lives i.e. things we’ve paid for in the past that give us (or our loved ones) the right to sell and hence PFL in the present and future?

- Trial period agreements.

- Product warrantees, price-matching features and money-back guarantees.

- Sublease clauses. For example, you rent a two-bedroom flat and there’s a clause in the lease agreement allowing you to rent out the second bedroom for financial benefit.

- Your estate (once you’ve paid the solicitor to draw up your will). Ownership of this option transfers to the beneficiaries of your estate, upon your death.

Real options and student career advice

In the general education system, little emphasis seems to be given to teaching students how to manage their real options. Then, when students graduate & join the workforce, they lack awareness about real options management in the workplace. Instead, at best, students receive advice from relatives, friends or teachers about getting a good education and working hard, to open up more life choices to them.

Perhaps too many young people learn from life experience – the ‘school of hard knocks’ (why doesn’t Western culture strongly preach the folly of learning this way?). And learn from repeat situations (once bitten, twice shy), that having choices is valuable.

What the young people need is more advice on how not to get bitten. And coaching to position themselves to have choices other than getting bitten. Young adults may also learn from observation – being inspired by designers to mimic the design flexibility that they see.

In the view of this blogger, one of life’s ironies is that for many young people, by the time they realise that older people’s advice to them on the above things is just as relevant today as in yesteryear, the consequences of have few options and choices is already hitting them hard.

In summary, holding real options in our personal lives, is a tangible form of personal flexibility. It follows that if we want to increase our PFL, we should accumulate real options in advance, in the areas of PFL that we want to improve.

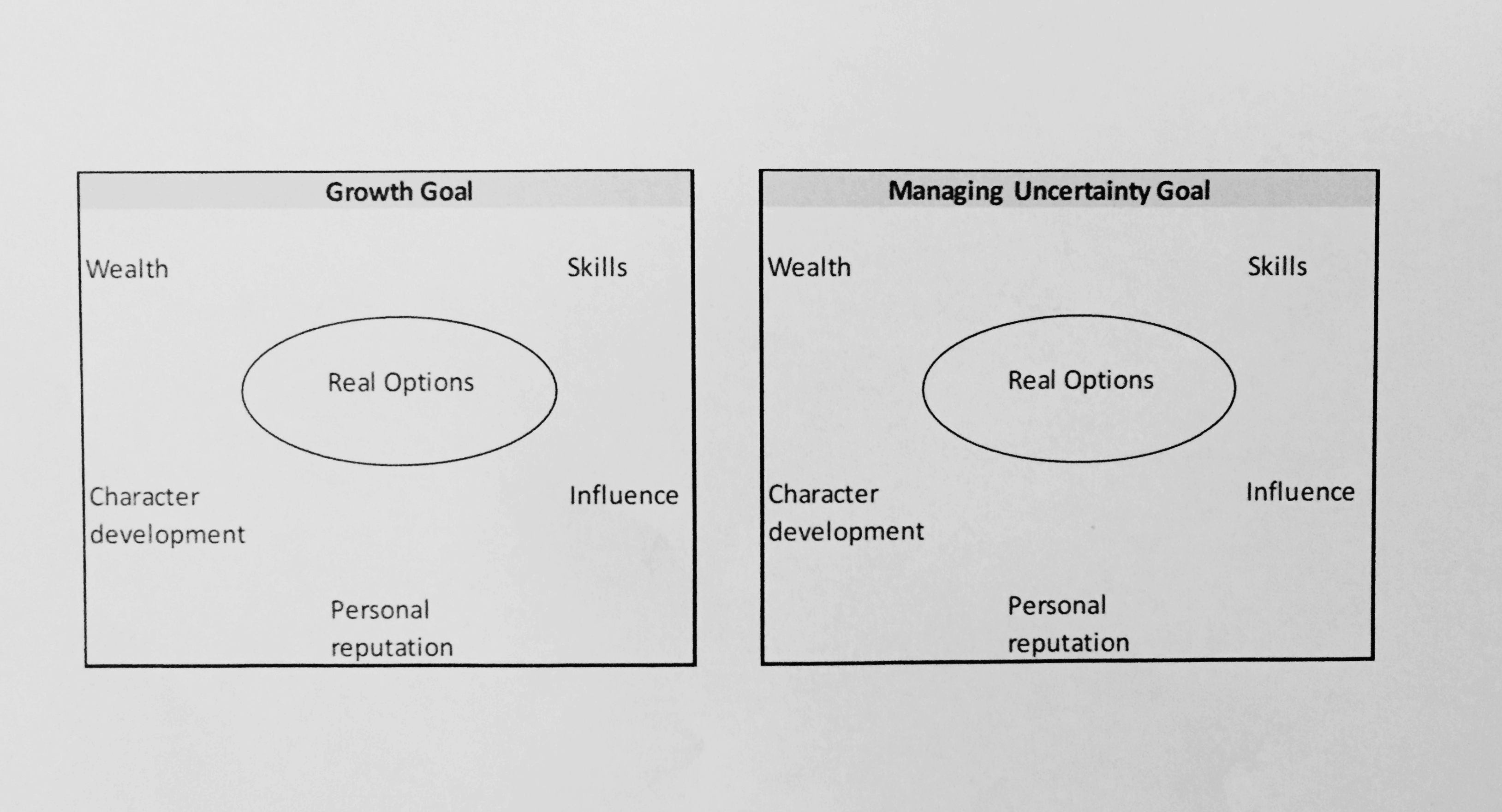

Some areas to look at, if personal growth and uncertainty management are some of your goals; obtaining real options concerning wealth, skills, influence, personal reputation and/or character development. A key point is to build up an ‘options portfolio’ i.e. don’t just concentrate on obtaining real options relating to one of them.

Periodically, we will use or ‘exercise’ many of the real options we hold, so another key point is to replenish our stocks of real options regularly.

If you found this blog helpful, feel free to tell others. Constructive comments are also welcome.

Simon